In this column, the first idea that may come to mind with regard to cash and cash management is to accelerate the collections from accounts receivable. Accounts payable however is another factor of cash management which is also equally important. Accounts payable definition and the process of how to set up a proper accounts payable process is outlined below.

What is Accounts payable?

Accounts payable refers to the quantity a organisation owes to its suppliers or creditors for goods and offerings obtained however now not yet paid for. It is recorded as a legal responsibility on the stability sheet.

Meaning of accounts payable

Accounts payable refers to the cash owed to the subcontractors or vendors for products and/ or services. Accounts payables are outstanding bills which are due for payment within the next three to twelve months. In the balance sheet equation, accounts payable is a part of the liabilities balance.

Assets – liabilities = equity

The balance sheet accounts are classified into the current and non-current account.

The components of accounts payable

The accounts payable components comprise of trades payable, debt, and credit card balances. Let me share with you some of them that impact on the overall accounts payable system you have.

Current liabilities

Accounts payable is part of current liabilities that represents the company’s short-term debts, due for payment in less than 12 months. Current liabilities also include:

- Trades payable: A few firms use trades payable to capture invoices received from the suppliers. Other companies record the supplier invoices using the accounts payable and do not make use of trades payable account.

- Short-term debt: Interest accrued on a loan and interest on the loan are charged to current liabilities. If a firm amounts to Rs 3,75,817.50 in principal and interest for the next twelve months then the balance is a current liability.

- Credit card balances: Maturity of credit card balances are recorded under current liabilities.

Noncurrent liabilities

Other liabilities are reached when a company has to borrow money that is due in over a year’s time. A large portion of balance on a five years loan, for instance is usually accounted for as a long-term (non-current) liability.

Present-day assets

Other balance sheets include current assets details which is the cash and balances expected to be paid with 12months. Accounts receivable and Inventory fall under current assets. It implies that a fixed asset, for example, machinery is noncurrent of which it is an account.

The accounts payable balance affect the cash flow of your business since it is an obligation that needs to be paid.

Impact of cash flow

The business owners need to keep track of the balance in the accounts payable and make prompts payment by using the cash forecast. Fund position is always considered crucial because every business requires a certain amount of buffering cash. It is essential that owners decide when the cash is to be received from account receivables, more especially when paying for account payables.

To manage cash flow, create a monthly cash flow roll forward using these line items:

- Beginning cash balance

- Revenues of cash receipts from customers, accounts receivable and other cash receipts

- Outflows in the form of accounts payable, inventory acquisition cost and cost of employee salaries.

- Ending cash balance

Cash balance at March ends is equal to cash balance start at beginning of April. Check out your company’s balance sheet and examine every single asset and liability account to ascertain its effect on money flow.

For you to work, you have to organize and come up with a proper system to deal with the payments.

Difference between accounts payable and accounts receivable

Accounts payable is the list of all the money your business owes to its suppliers or vendors. Remember it as debts that you have to clear. When you buy goods and services on credit, then the sum goes to the accounts payable where it stays until you clear the balance. It is therefore important to manage accounts payable effectively so that you can have a good relation with your suppliers and also avoid incurring penalties.

On the flip side, accounts receivable is the amount of money which your customers owe to your business. This is where if you offer goods or services on credit basis then the amount due is recorded under account receivables until the time payment is made. It is therefore important to keep a close eye on accounts receivables so as to receive payment from customers on time and in turn facilitate a good cash flow.

What is the department of accounts payable responsible for?

The accounts payable (AP) department is responsible for implementing the whole accounts payable process. Regarding vendor payments, approvals, and reconciliations, the department is also a major force behind supporting the entire organisation.

Some examples of this include

- Subcontractors

- Equipment

- Utilities

- Licensing

This is basically the skills required in the accounts payable role

Not like accounts payable has many sub-processes, there are also many skills that are necessary to complete accounts payable. For example:

- General accounting rules: You will have to understand how debits and credits impact on the balance sheet they belong to.

- Organization: Making and ensuring invoices are well arranged helps in the easy running of the AP department and payment.

- Personability: Most of the employees in the AP department are very much involved with interacting with the vendors. That is why having positive vendor interactions may be the key to the difference between good and bad vendor experiences.

All of these skills are necessary and desirable in the AP department, Nevertheless, most businesses use automation solutions including QuickBooks Online where they can also automate, sort, and optimize AP work.

Also Read | 2024 Salary paycheck calculator

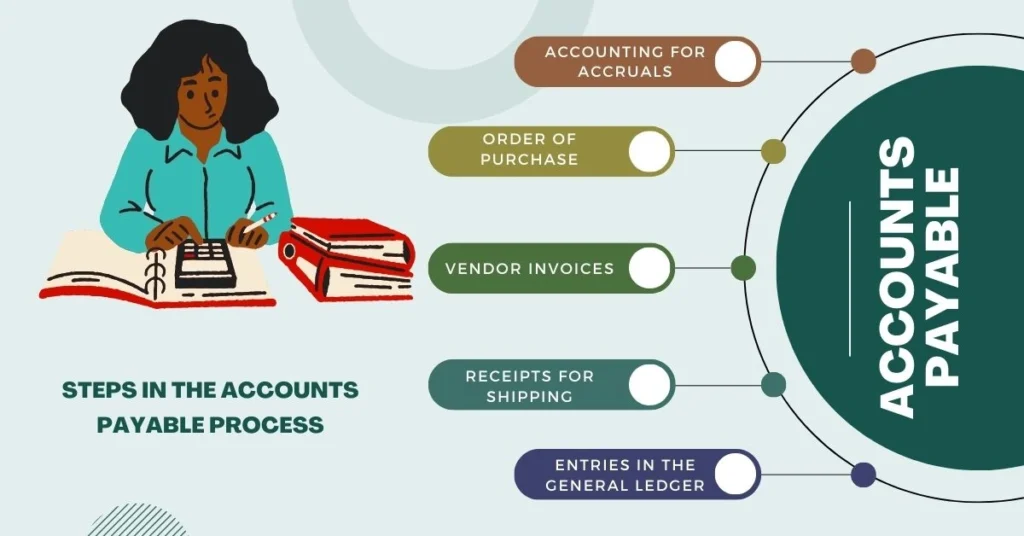

Steps in the accounts payable process

You must publish transactions using the accrual basis of accounting in order to manage accounts payable. The procedure is visible here:

- Accounting for accruals

- Order of purchase

- Vendor invoices

- receipts for shipping

- Entries in the general ledger

1. Make use of accrual accounting

Businesses the usage of accrual accounting need to document profits while it’s far obtained and prices as they are incurred on the way to produce profits. Regardless of whilst cash flows arise, accrual accounting have to be used by all corporations to ensure that revenue and expenses are identical.

For the cause of posting transactions and financial reporting, the debts payable department need to hire accrual accounting. Consult with your AP branch to set up a nicely-defined process. Accounts payable may be dealt with by using an accounting group of workers member if your company is smaller.

2. Deliver the purchase order

POs are necessary for the majority of spending choices. For example, let’s consider Acme Manufacturing desires to reserve a ₹ 8,35,150 piece of gadget. The plant supervisor need to entire a PO, which incorporates the machinery’s pricing and different details, previous to putting the order.

Approved through the owner or any other responsible party (consisting of the CFO) for price range. Orders may be placed at this factor. For instance, a ₹ 3,340.60 buy of office components does no longer require a purchase order. POs are generally most effective used for major purchases totalling extra than ₹ 83,515 Purchase orders aid in cost containment and hold control informed approximately cash outflows for a company.

3. Get the bills from the vendors

An bill from the vendor can be despatched after the order is positioned. The following info must be entered into the accounting system by way of the character in rate of debts payable duties:

- Due date: The day on which fee is due on the bill

- Payment terms: If an bill is paid within five to ten days, some dealers will provide you with a discount. You may want to select to settle the invoice sooner if a discount is provided.

- Contract information: Included inside the settlement facts are the consumer’s bill number, the seller’s name, cope with, and e-mail. Include that facts together with the invoice facts if the vendor accepts electronic bills.

- Goal: Please provide an outline of the purchase if you want to schedule the charge for a larger transaction.

A transport receipt from the vendor ought to be included when the object is obtained.

4. Obtain a shipment receipt

What become bought through the seller to the consumer is certain within the cargo receipt. Along with the amount of factors within the bundle, the receipt offers a description.

There should be consistency inside the data supplied on the acquisition order, bill, and cargo receipt. It is confirmed through looking over these files that the order become widely wide-spread and that the things you asked arrived.

An accounting branch cheque can be generated if the records fits. Before signing the cheque and paying the invoice, the proprietor should pass over all the office work.

The AP branch should publish accounting entries further to overseeing paperwork.

5. Post general ledger entries

Journal entries are entered into the overall ledger by using the accounts payable branch. A journal access has all the details required to report a transaction. For bills payable, a purchase made on credit score and an bill paid in cash are the 2 standard magazine entries.

Credit-primarily based buy

On March 5, Acme Manufacturing publishes the following magazine access after putting the ₹ 8,35,150 piece of equipment order:

- Debit #3100 machinery (asset account): ₹ 8,35,150

- Credit #5000 accounts payable: ₹ 8,35,150

(To record the credit score-primarily based equipment buy on March 5)

In order to raise the equipment asset account (#3100), Acme files a debit; with the intention to enhance debts payable (#5000), it publishes a credit score.

The date, money owed, financial quantities, debit and credit score entries, and an outline of the transaction are all blanketed inside the journal access.

The quantity owed on the account is reduced when the bill is paid.

Cash payment for the invoice

On April 6, Acme Manufacturing posts this journal entry and pays the invoice:

- Debit #5000 accounts payable: ₹ 8,35,150

- Credit #1000 cash: ₹ 8,35,150

(To document the payment of the April 6th invoice)

Acme records a credit for less cash (#1000) and a debit for less accounts payable (#5000).

Automation of accounts payable has advantages

The way you cope with the money of your organisation might be completely changed via automating the money owed payable technique. Among the benefits are:

Enhanced effectiveness

Processing bills and invoices through hand may be blunders-prone and time-ingesting. These chores can be streamlined with automation, saving your crew time on administrative labour and letting them deal with more strategic endeavours.

Enhanced precision

Errors that may show up when handling records by hand are reduced while automation ensures accurate records collection and processing. This leads to more reliable monetary records and less disputes to settle.

Improved consciousness and control

You may additionally see your monetary scenario in actual time with automatic bills payable. You may also swiftly make well-informed selections by means of keeping an clean-to-observe file of fantastic payments, charge statuses, and general cash go with the flow.

improved connections with suppliers

Reliability and punctuality in bills contribute to the upkeep of effective supplier relationships. Automation lowers the possibility of late penalties and builds confidence with your carriers by means of ensuring that invoices are processed and paid on time.

Savings on costs

Because automation removes the need for manual intervention, it may bring about good sized fee financial savings. It reduces the quantity of sources needed to handle office work and execute bills, which in the end lowers operating costs.

Safety and compliance

Financial statistics is safeguarded through the inherent safety capabilities of automatic systems. They also can help to make sure that regulations are accompanied, which lowers the possibility of consequences and prison problems.

Using QuickBooks to automate money owed payable will enhance your business enterprise’s productivity, accuracy, and growth. Give QuickBooks a danger to help you in managing your cash so you can give attention to what you do excellent—walking your corporation.

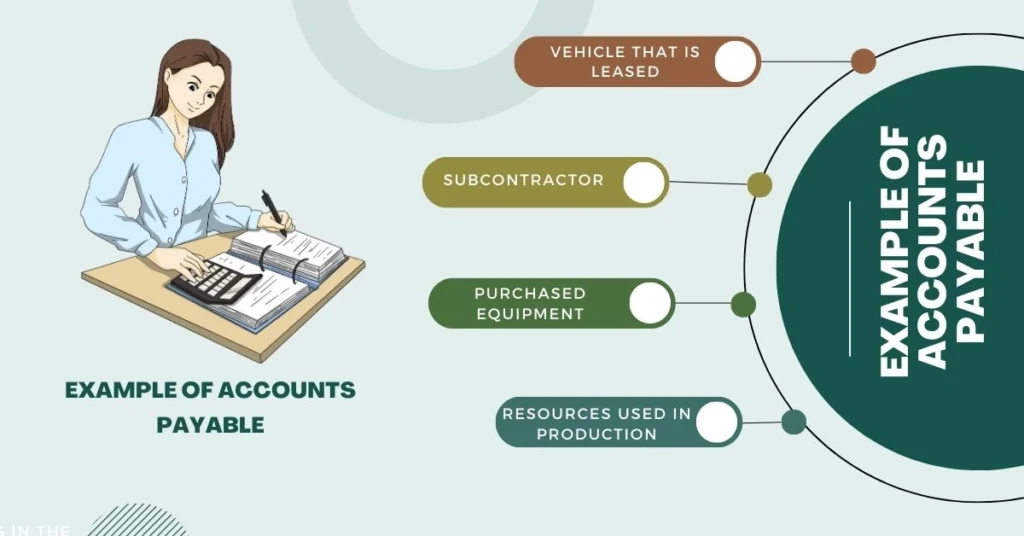

Example of Accounts payable

On the stability sheet, any object or provider that the enterprise purchases should be diagnosed as money owed payable. Among the times are:

- vehicle that is leased

- Subcontractor

- Purchased equipment

- Resources used in Production

AP management advice

To grow your employer, you should hold a watch on money owed payable and put in force upgrades. The following three metrics are vital for managing money owed payable:

Boost the turnover of debts payable

Credit purchases increase the amount owed on bills payable. The total quantity of credit score purchases divided by way of the common quantity of money owed payable is called bills payable turnover. Usually, the measured duration is one month or three hundred and sixty five days.

Assume that a company purchases a significant amount of cash in March on credit and right away settles the bills. Although the common accounts payable balance might just be a few days, the March purchase balance is massive. You can pay for credit score purchases greater fast if you enhance the turnover ratio of accounts payable.

You may need to wait longer to pay invoices in case you need to store money. You can postpone payment till you get extra price from clients if the bulk of your payments are due in 30 days or much less.

An additional beneficial device for dealing with payables is the accounts due ageing schedule.

Reduce the ageing agenda for bills payable

Accounts payable balances are divided in step with an growing old agenda that counts the times for the reason that invoice was despatched. For instance, Acme Manufacturing owes ₹ 12,52,725 in the class of 31 to 60 days antique and ₹ 83,51,500 in payables from zero to 30 days vintage.

The getting older schedule aids in figuring out the due date for bill bills. Your payables should fall more often than not in the zero-to-30-days-old group. You don’t need quite a few unpaid invoices that are still high-quality after 30 days because most invoices are due within that time.

You run the danger of destroying your courting with the seller if you delay making charge. Reputable suppliers are crucial, and you ought to pay them on time table. Manage accounts payable through taking motion.

Simplify the AP manner

Streamlining your accounts payable process with performance is surprisingly endorsed. Using essential factors is the best method to perform this. Among them are:

- Invest in automation software to beautify your productivity. (See extra approximately this under.)

- strengthening the bonds you have with your providers. Specials and reductions are a long way more likely to be offered through suppliers who experience favored.

- Efficiency by using switching to digital filing systems from paper ones. The anguish of getting to bodily go through mountains of paper documents whenever you need a report is eliminated if you have digital files.

Best practices for money owed payable

The following are some notable practices to keep the fitness of your money owed payable:

Establish a transparent approval system: To assure accuracy and stop unapproved payments, establish a uniform method for approving invoices.

Employ automation tools: To expedite bill processing, decrease errors prices, and shop time, make use of computerized structures like QuickBooks.

Keep track of cut-off dates: Remember while payments are due which will live out of problem with the regulation and to preserve your suppliers happy.

Regularly reconcile accounts: Account reconciliation have to be performed on a normal foundation to guarantee that your economic information are accurate and modern-day.

Set up indicators: To be informed approximately impending bills and prevent lacking closing dates, use indicators and reminders.

Negotiate payment terms: Work with your suppliers to reach agreeable arrangements for payments that will meet your demands for cash flow.

Watch your cash flow: Make sure you have enough money to pay your payables by keeping a careful check on your cash flow.

Ensure that your records are accurate: Make sure that all payment and invoice data is precisely logged and readily available for future use.

Train your team: Review and audit your accounts payable procedure on a regular basis to find areas for improvement and stop fraud.

Educate your group: Teach your staff the value of precise and timely accounts payable administration as well as best practices.