Understanding the cost of goods sold computation is essential for businesses seeking accurate financial reporting and effective inventory management. This key metric, often abbreviated as COGS, directly impacts profitability, making it crucial for business owners and accountants alike. In this guide, we will explore how to find the cost of goods sold, delve into the COGS calculation formula, and clarify common queries about its definition and application.

In fact, precise calculation of the cost of goods sold is not only a financial imperative but a competitive weapon. It makes sense in matters of price, budget planning or sharing and forecasting and is key to the financial management of the business.

What is COGS?

cost of goods sold computation- To define what exactly the cost of goods sold is prior to moving towards learning how to compute for it, let’s first look at what COGS stands for. They refer to the manufacturing cost inherent to the goods directly sold by a firm or business. This includes expenses such as:

- Raw Materials: The items and materials which serve as basic requisites in the production of most products.

- Labour Costs: Compensation package of the employees engaged in the production process.

- Overhead Costs: Overhead costs that are associated with manufacturing include expenses on lighting, housing, and maintenance of structures used in production.

In other words, the cost goods sold formula assists firms in evaluating the costs that were used in the manufacture of their goods and the implication to their profit.

The Importance of COGS

The cost of goods sold calculation formula is not just an accounting formality; it serves several vital functions:

- Profitability Analysis: Knowing your COGS is the key to identifying the gross profit and the company’s health, as a result.

- Inventory Management: It makes it easy to control and monitor the inventory since accurate computation is used in it.

- Tax Reporting: COGS is an indirect cost, vested upon the line of taxable income.

- Cash Flow Management: It can also assist in better-controlling cash flow since knowledge of the amounts allows for adequate availability of cash for working needs.

- Pricing Strategies: Knowledge of COGS enables the organization to set proper prices for its products in an effort to make the products affordable while at the same time maintaining adequate profits.

Cost of Goods Sold Formula

To compute the cost of goods sold, you can use the following formula:

COGS=Beginning Inventory+Purchases−Ending Inventory

Key Components of the Formula

- Beginning Inventory: These include the value of stocks of goods at the beginning of the accounting period.

- Purchases: It is the gross total of the additional inventories bought during the period in question.

- Ending Inventory: The current quantity of stocks at the close of the period as a component of the Asset Account.

Each of these is important since any inaccuracy in one area or another will lead to wrong COGS determinations.

Also Read | Standard Accounting: Reliable Financial Solutions

How to Find the Cost of Goods Sold

Now that we understand the cost of goods sold formula, let’s explore how to find the cost of goods sold in practice:

- Collect Inventory Data: In the first step, opening stock, purchases and closing stock of crediting itself or credit standings will be gathered.

- Apply the Formula: Plug your values into the formula for COGS mentioned above.

- Analyze Results: Evaluate the potential of the established COGS in affecting the gross profit as well as the general financial position of an organization.

Example of COGS Calculation

To illustrate the COGS calculation formula, consider the following example:

- Beginning Inventory: $10,000

- Purchases: $5,000

- Ending Inventory: $4,000

Using the formula, we calculate:

COGS = 10 , 000 + 5 , 000 − 4 , 000 = 11 , 000

Thus, the cost of goods sold for this period is $11,000.

Variations of COGS Calculation

While the basic cost of goods sold calculation formula is widely used, different businesses may adapt it based on their needs. Here are some common variations:

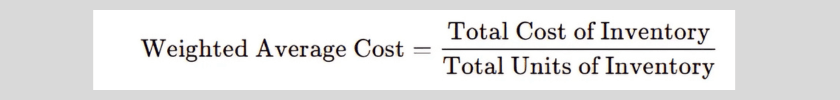

- Weighted Average Method: This method helps to spread out the costs of holding inventory over a specific period of time and thus can easily help in a variation of stocks’ prices.

Formula:

Weighted Average Cost = Total Cost of Inventory /Total Units of Inventory

FIFO (First In, First Out): This method gives the belief that the first stock in the inventory to be sold is the oldest one. It is useful during increased price levels as it leads to decreased COGS.

LIFO (Last In, First Out): This assumes that the most recent inventory is the first to be sold, and given this assumption there is a tendency for higher COGS in inflationary periods hence less taxable income.

COGS and Financial Reporting

Accurate cost of goods sold computation is crucial for financial reporting. Here’s how it impacts key financial statements:

- Income Statement: COGS is directly linked to gross profit since the formula for gross profit is as follows.

Gross Profit=Sales Revenue−COGS

- Balance Sheet: There is not much difference between SOC 1 and SOC 2 audits as they both restrict monetary misstatements, and precise inventory values leading to proper asset estimations. The amount of ending inventory computed has an impact on the company’s balance sheet as well as income statement.

- Cash Flow Statement: There exists a relationship between the operating cash flows and inventory situations.

Tips for Accurate COGS Computation

To ensure the accuracy of your cost of goods sold computation, consider the following tips:

- Maintain Detailed Records: Maintain accurate records of all the inventory transactions such as receipt and invoices, inventory takes among others.

- Regular Audits: In this method, it is important to conduct routine audits to confirm inventory balance and cost which if inaccurate will be realised early.

- Utilize Accounting Software: Utilise technology in the form of programmed description, use of software for the regular inventory update and computation of the COGS.

- Train Staff: Make certain that those who are in a position to handle inventory management within the enterprise should do so accurately, having been trained on how to prevent or eliminate errors in the course of undertaking their work.

- Adjust for Returns and Allowances: Records return and allowances since they form part of COGS.

Conclusion

In conclusion, mastering the cost of goods sold computation is vital for accurate financial reporting and effective business management. By understanding how to find the cost of goods sold and applying the correct COGS calculation formula, businesses can better assess their profitability and make informed financial decisions.

Possible administrative measures for improvement of financial and strategic performance assessment can imply the detailed approach to Actual Inventory management and the regular COGS review. Whether you want to learn COGS to forge your small business or to become an expert in the accountancy profession, the commentary under will help you understand how and why the segregation of the information will enrich the financial statements and provide you with essential insights to make better business decisions.

If implemented in this guide, the preparation process of the financial reports will be accurate and increase the general performance of your business.

COGS Questions Frequently Asked

What is the full form of COGS?

COGS stands for Cost of Goods Sold which is actually an acronym. This term is used in accounting and finance to express direct cost This term is borrowed from financial accounting and finance to mean direct cost This financial term used in financial accounting and finance to mean direct cost.

What does COGS mean in business?

When used in business, the acronym COGS stands for cost of goods sold – costs of the goods sold within a particular period that must be considered when calculating profit.

What is the sold price formula?

The sold price formula can be derived from the COGS by adding the desired profit margin:

Sold Price=COGS+Desired Profit

For example, if your COGS is $11,000 and you want a profit of $2,000, your sold price would be:

Sold Price=11,000+2,000=13,000