Starting a business involves several key steps: In this case, one needs to select a good business idea, develop a good business strategy, and acquire the requisite capital. Then, register your business, get licenses and advertise your business well.

1. Choose Your Business Idea

Identify a business idea that solves a specific need or problem. Conduct thorough market research to validate your idea and understand your potential customers. Define your core concept and create a value proposition that highlights your competitive advantage.

Consider Popular Business Ideas

If you’re passionate about starting a business for social purposes, consider these popular ideas that many people have embraced:

- Start a Franchise

- Start a Blog

- Start an Online Store

- Start a Dropshipping Business

- Start a Cleaning Business

- Start a Bookkeeping Business

- Start a Clothing Business

- Start a Landscaping Business

- Start a Consulting Business

- Start a Photography Business

2. Research Your Competitors and Market

To succeed in business, understand your competitors and the market. Here’s a streamlined approach to get you started:

Identify Competitors: Start with direct rivals offering the same products/services and indirect rivals offering satisfactory alternatives. This helps you understand your competitors and their strengths.

Collect Information: Collect data from competitor websites, social media, and client feedback to analyze their products, pricing, promotions, and target markets. Use this information to identify gaps and enhance your strategic development.

Analyze Strategies: Compare competitors’ prices, promotions, and selling channels to understand how they attract and retain customers. Make use of these insights to improve your own tactics and differentiate yourself in the market.

Understand Market Trends: Take into account the market’s size and potential for expansion. If you want to effectively create your product development and marketing strategy, segment your consumer base and keep up with current trends.

Conduct a SWOT Analysis

With the help of the SWOT analysis, one gets an understanding of the competitors’ strength, weaknesses, opportunities, and threats for further planning on how to increase the size. It offers data before decision making in the market place is made. Besides, there is need to come up with a business plan for the vending of machines for it to attract investors whenever the business is to be started. The following are some of the aspects that an organization requires to possess in order to be relevant in the business as follows;

3. Create Your Business Plan

In a business, producing a business plan is crucial so that there will be a proper of the company’s vision and profit making strategies. Here are the key components to include:Here are the key components to include:

Executive Summary: A short description of your enterprise like its vision, what you are offering your clients, and what revenue per month you expect.

Business Description: Specific facts and figures about your organisation, how ever it is structured, and what goals it seeks to accomplish.

Market Analysis: Market research about the customer base among the targeted market segments and customer necessities.

Competitive Analysis: Make competitors’ map and define your competitive advantage.

Marketing and Sales Strategy: Explain the strategies that you are going to deploy in terms of customer acquisition and customer retention.

Financial Projections: Make projections for the revenues, costs and profits during the period of three to five years.

Organizational Structure: Explain the members of your team and the position they hold in the business organization.

Funding Requirements: If you are in search of funds, state the amount you require and what the money is going to be used for.

A business plan outlines what the business is, what it does, how it operates, and the strategies for success. It is crucial when seeking credit or investors.

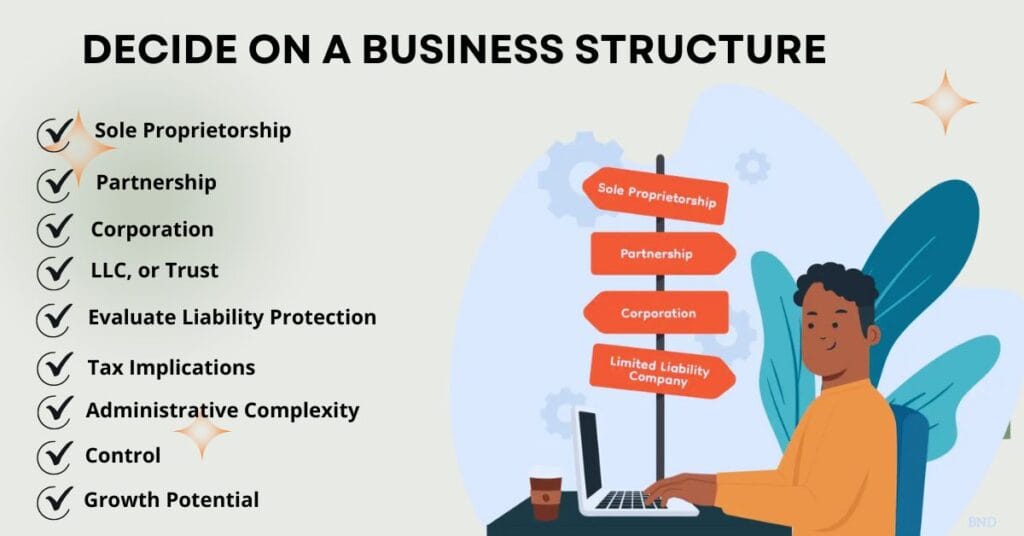

4. Decide on a Business Structure

Sole Proprietorship

The next business form is the sole trader where business is owned by one person who controls the business, takes all profits and is personally liable for the business losses. Due to its clear structure and the absence of complicated moments, it is used by small business owners.

Partnership

A partnership is defined as a business which is operated and established by two or more persons who share the profits and losses as well as the debts incurred. It enables one to share employees, management talents, and other resources thus explains why many business people prefer it.

Corporation

Corporation is a legal entity that was created separately from its owners that aim at providing limited liability to its shareholders. It helps in the selling of stocks to obtain capital and has an unlimited life span irrespective of owners’ changes.

Limited Liability Company (LLC)

An LLC combines partnership and corporation features: revenues are levied from members and it holds protection of its members from legal responsibility to the amount of stock they have invested in it. It allows members to conduct the business and relieve themselves from personal liabilities as associated with the business.

Trust

A trust is a legal arrangement where trustees manage assets for beneficiaries. It helps save on taxes, avoid probate, and ensure the grantor’s wishes are followed in managing the estate.

Key Factors

Liability Protection: Corporations and LLCs give people the most protection of their assets.

Tax Implications: Individuals and firms that operate alone or in partnership opt for self taxation As for companies, they are also subjected to both company taxation and persons taxation.

Administrative Complexity: Sole trader structures require the least writing and filing of various documents and conform to few legal requirements.

Control and Management: There is full control of business activities since sole traders have complete control of the business.

Growth Potential:The next question is whether it is suitable for the achievement of long-term strategies and investment requirements.

5. Obtain Licenses and Register Your Business

After deciding the business structure, the next task is to legally formforming your business. Depending on where you are and the kind of business you want to establish, then the registration procedures will differ.

Business Name Registration: Select the name of the business and check on whether it is available government or state records. You may also have to do some paperwork as in possible registration of the name with the local authorities or the trademark bureau.

Obtain Necessary Licenses and Permits: Obviously, the licenses or permits that are necessary may be federal, state and regional depending on the nature of the business. these could be healthbe the health, safety, zoning or environmental permits.

Tax Registration: Visit the tax office within your country to fill in for a tax identification number known as the TIN or EIN. This number is very important when it comes to paying business taxes, obtaining permits to employ people and even opening a business bank account.

Comply with Local Laws: Make sure that you follow the local laws in terms of licensing for instance by registering with the county or municipality depending onwith the operating permits.

Get Insurance: It might pay to obtain business insurance (such as liability, workers’ compensation) as to avoid risks to your business.

Register your business and obtain the necessary licenses to operate legally, avoiding future legal issues and complications.

6.Organize and manage business finances

The money issues are always among the most important factors in the success of the business.

Open a Business Bank Account: Ensure that your private and business spending is split by acquiring a business account with a business bank. This assists in proper records keeping and planning for taxes the other being It aids in keeping track of expenses and revenues.

Set Up Accounting and Bookkeeping Systems: Use accounting software or hire a bookkeeper in order to manage money in and money out. It is also good to note that bookkeeping keeps you upright and gives you a precise physical description of your financial health.

Create a Budget: A good budget to help you anticipate your costs, revenues and profits need to be created. It assistsassist in the balancing of funds, decision on expenditure and acquisition of materials for development.

Understand Your Tax Obligations: For more information about business taxes review. This could be sales tax, payroll tax, or even corporate taxes among others Due to these, it is always important to consult your accountants or lawyers for advice. They have to ensure that their operations are within the regulation to avoid being penalized.

Secure Funding: In the event, there is a need for the extra capital then one will have to consider getting a business loan, attract investors, or liquidate some of his/her personal assets to generate the required capital to meet the expenses of startup and running the business.

Sustainable and growing businesses are made possible through good management especially of financial resources.

7.Secure Business Funding

Finding the right funding is crucial to turning your business idea into reality. To secure the necessary funds, consider various financing methods based on your business’s growth potential and requirements. Here are some common ways to raise funds:

Personal Savings: As for the last disadvantage, it is when you personally contribute your own money as this cuts your debenture but equally limits your funding.

Bank Loans: Being a form of a conventional loan from the bank conventional loans depend on the business plan and the stability of the business financially.

Venture Capital: Money is received in anticipation of a share in the company, those business ventures with high growth profitability potential.

Angel Investors: Money is provided by the richer people in exchange for the shares or the bonds which can be converted into shares.

Crowdfunding: Such websites as Kickstarter enable you to collect relatively small amounts of money, but from numerous people.

Effective business planning, accurate funding estimates, and securing the right funding are crucial for demonstrating growth potential and profitability to investors and lenders.

8. Get Business Insurance by Applying

Forget about the risks affecting your business by getting adequate insurance by evaluating the type needed like liability, property, and worker’s compensation. SP: Search for all the policies that a number of providers offer to ensure that you obtain the right coverage for your case. Obtain an insurance and be honest when filling the details to be covered to get adequate insurance. To ensure you have made all the necessary changes consider reviewing your policy when you observe changes in your business. Such a strategy is useful in preventing disastrous risks and desired monetary deficits. Keeping up with the adequate coverage for your business is also important for the long term security for your business.

9.Run a Business the Right Way

1. Identify Your Needs

Business Functions: An understanding has to be made of what instruments are needed for business, for instance, accounting solutions, managing clients, or monitoring projects.

2. Choose Essential Tools

Accounting Software: Microsoft places as an option to organize the finances and pay-roll or QuickBooks or Xero or any other similar application.

Customer Relationship Management (CRM): Applications, such as for customer relationship and sales, including but not limited to; Salesforce and HubSpot.

Project Management: Tools such as Asana or Trello for the tracking of tasks and work collaborated among the team.

Communication Tools: Communication internally should be done by using either slack for business or Microsoft teams whereas video conferences should be done through either Zoom for business or Google meet.

Marketing Tools: For the campaigns such as the emails use the Mailchimp, while the website performance use the google Analytics.

3. Evaluate and Implement

Compare Options: To compare different tools use criteria such as features, usability and price.

Trial Periods: Be sure to seize trial offer as this helps one test functionality and compatibility to business processes.

Training: Make sure that both you and the members of your team understand how to go about using the particular tools.

10. Market Your Business: A step by step process

Define Your Target Audience

Identify your customers by age,Gender, income, location, hobbies, beliefs, attitudes, and behaviors. This helps in crafting effective marketing messages and choosing the right media.

Develop a Marketing Strategy

Create a distinctive brand image with a unique selling proposition (USP) to stand out. Ensure your messages align with your company’s vision and appeal to your target audience.

Choose Marketing Channels

Utilize both online (SEO, social media, email) and offline (flyers, ads, networking) marketing techniques to reach your audience.

Create Compelling Content

Use blogs, informative materials, videos, and images to capture attention and communicate your message effectively.

Implement Advertising Campaigns

Leverage Google Ads, social media ads, sponsorships, and influencers to boost brand recognition and attract users.

Monitor and Analyze Performance

To monitor website traffic, engagement, and conversions, use tools such as Google Analytics. Adapt tactics in light of performance information.

Build Relationships

Respond to customer messages and offer rewards to foster loyalty and increase revenue. Strong customer relationships lead to long-term success.

11.Expand your business

Expanding Your Business

To grow your business, focus on increasing the number of clients and their revenue. Expand marketing activities, enhance your product range, or collaborate with other producers. Offering new complementary products or services can also drive growth.

Delegation and Automation

If you need more time for development, delegate tasks or use automated systems. Tools like Hootsuite can manage social media accounts, and automation can streamline lead generation, marketing, and accounting tasks.

Financial Management

Ensure financial success by closely managing your finances. If income falls short of expenses, find ways to increase revenue or reduce costs. Proper financial oversight is essential for business growth.

Forming a Team

As your business grows, delegate tasks and build a team. Hire employees, use recruitment platforms like Indeed and Glassdoor, or post on job boards and social media. For short-term needs, consider freelancers on platforms like Upwork and Fiverr.

Exploring Partnerships

Consider strategic partnerships within your industry. For example, a wedding planner could partner with caterers and photographers. Online sellers might use fulfillment houses to streamline operations. Explore alliances with businesses offering complementary products or services to your target market.