In the world of finance, equation accounting is a tool is critical in the management of financial affairs. By making good use of accounting equation and the right balance sheet formulas, whether you are an expert accountant, or a small business owner, you will be well positioned to control and main your financial health. In this accounting blog, we will explain key fundamentals and introduce various questions based on accounting equations as well as important ratios to assist you to take charge of the financial matters.

What is Equation Accounting?

The recording method in financial accounting is called the equation accounting, whereby every account recorded balances another account. The basic principle of equation accounting as that every action has an equal and opposite reaction, a principle common to physics in the form of Newton’s first motion law. The fundamental equation we use is the accounting equation:

Accounting Equation

Assets = Liabilities + Equity

This bare-bone mathematical model constitutes the basis of every financial statement that communicates to the reader that assets are financed by liabilities (debts) or equity (owner’s funds).

What is Capital in Accounting – a Crucial Part of Balance Sheet?

In order to understand the usage of the accounting formula, one has to understand what is capital in accounting. Capital is the owner’s wealth locked in the business and this is part of the equation accounting model. It features in the balance sheet under equity and can be improved either by investing or out of retained profits. To identify what is capital in accounting, it is easy to distinguish between funds owned by the business and the funds owed to others.

For example

- If a business owner invests $50, 000 this is capital and the equity will be adjusted upwards in the accounting equation.

Solving Accounting Equations Questions

The ability to solve accounting equations questions is a key element in the ability to analyze financial statements. These questions are normally solved by applying alterations to the accounting formula in which different unknown factors such as assets, liabilities or equity may be solved for. Accounting equations questions form the basis of most financial statements and, therefore, through solving them, you will be well placed to analyze financial health at first glance.

Here’s a typical example of accounting equations questions:

- If a company has total assets of $100,000 and total liabilities of $40,000 what is the equity capital?

- Using the accounting equation

Assets = Liabilities + Equity

Equity = Assets – Liabilities

Equity = $100,000 – $40,000 = $60,000

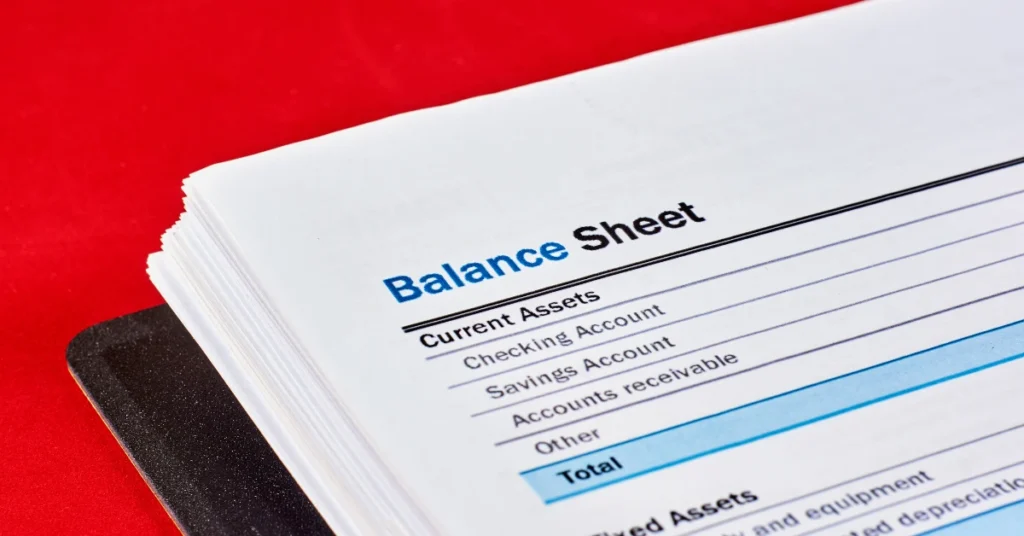

It is very important to grasp basic Balance Sheet formulas.

The balance sheet formulas are derived from the accounting equation still, and the balance sheet offers the shareholder a report on the company’s financial position at a given date. The balance sheet represents the details of total assets, liabilities, and equity funds, and the formulas used in them enable all the records to be correct.

Also Read | The Key Difference Between Liability and Asset

Balance Sheet Formulas include

1. Assets = Liabilities + Equity

This is the first calculation for the balance score sheet.

2. Working Capital = Current Assets – Current liabilities

This formula aid in evaluating the short term solvency of an organization.

3. Debt to Equity Ratio = Total Liabilities / Total Equity

Cross sectional data is a valuable measure and is used to depict leverage.

Further to this these balance sheet formulas help in determination of the stability of the company hence making informed decisions.

What is Accounting Equation?

The question “what is accounting equation?” , it seems that the workings of equation accounting are at the heart of the formula. It is the basic principle meant to enforce proper documentation of all financial conducts. The accounting equation is one of the basics of double entry bookkeeping system which guarantees reciprocal debit and credit.

If one has to define what the accounting equation in accounting is, then haring the same answer as before, it is Assets equals to Liabilities plus Equity. This equation is applicable in any kind of business and in any industry and therefore is important to anyone dealing with financial statement.

What Are Accounting Equation Variations?

However, no matter the circumstances, there is an accounting equation formula alteration to suit the variations of financial positions of different businesses. Variations of the accounting formula might include:

- Assets = Liabilities + Owner’s Capital

- Assets = Liabilities + Shareholder’s Equity

These variations involve whether the business is a sole trader, partnership or limited company. Hence, it is common to determine context of what are accounting equation components when comparing various business forms.

Formula for Accounting Ratios

The general formula used for most accounting ratios should not be underrated when comparing a company’s financial result. There is an ability to view the level of profitability, liquidity position, efficiency, and solvency of accounting ratios. It can be said that ratio analysis is very important and it is crucial to master all of these ratios.

Key ratios in accounting formulas include:

1. Current Ratio

Current Ratio = Current Assets / Current Liabilities

The ability of the business to fulfil short-term obligations is gauged by this ratio.

2. Return on Equity (ROE)

ROE = Net Income / Equity

This ratio reveals how efficiently the business is capable of making profit from the shareholders’ funds invested in the business.

3. Gross Profit Margin

Gross Profit Margin = (Total Revenue –Total Cost of Sales) /Total Revenue

This ratio reveals the ability of a firm to generate product or deliver service with reference to its income.

When you learn the formula for accounting ratios, then you can tell the position of a business entity on different dimension.

Applying Ratios in Accounting formulas

Ratios In Accounting Formula: Ratio analysis enables you to assess elements of financial performance that are not revealed by other means. For example:

- A Current Ratio above indicates that there is ability to pay off some of the current obligation of that business.

- A high figure for ROE is usually desirable, which points to a good management of equity capital for the purpose of making profits.

- A Gross Profit Margin that is healthy means that the organisation is proficient in producing services.

While using ratios in formulas they must be compared with industry average or previous years’ performance for enhanced understanding of the values.

Conclusion

Equation accounting is necessary for maintaining the balance of monetary affairs in one’s own life and of a business organization. These skills start from comprehending the basics such as accounting capital to solving accounting equations questions & Balance Sheets formulas help your financial data to be precise & most importantly useful.

Bear in mind that it is not about what is accounting equation and its variations and its additional rule, the formula for accounting ratios and what ratios in accounting formulas tell you? That said, with good understanding of these terms you are on the right path to mastering the craft of managing your finances through equation accounting.