Salary paycheck calculator – Employees can use these tools, which are an hourly and salary paycheck calculator, for free to know how much net pay they can get in accordance with their taxes and withholding. Obtain a true view of the EMLOYEE’S gross pay – base pay + overtime pay + commission + bonus + etc. Subtract state taxes and federal taxes as well as allowances which have been demanded by the employees to get a better understanding of the earnings per each individual. You can also get to know how you can automate your companies payroll using Quickbooks

What is the significance of getting it right with the pay checks?

It will also benefit employers since having an accurate paycheck computation is not only a concern of employees. It’s as mandatory as carrying your driver’s license for the proper use of your vehicle. Neglecting the lawful requirement to pay employees fairly—federally, state, or locally—can result in hefty fines, sometimes reaching a thousand dollars. One of the most common labor law violations is the lack of adequate payment for overtime worked. If you’re in states like California, New York, Texas, or Florida, where state laws often surpass federal regulations, you’ll need to be especially cautious. Using a paycheck calculator can help ensure compliance by accurately calculating wages, deductions, and overtime, reducing the risk of costly errors.

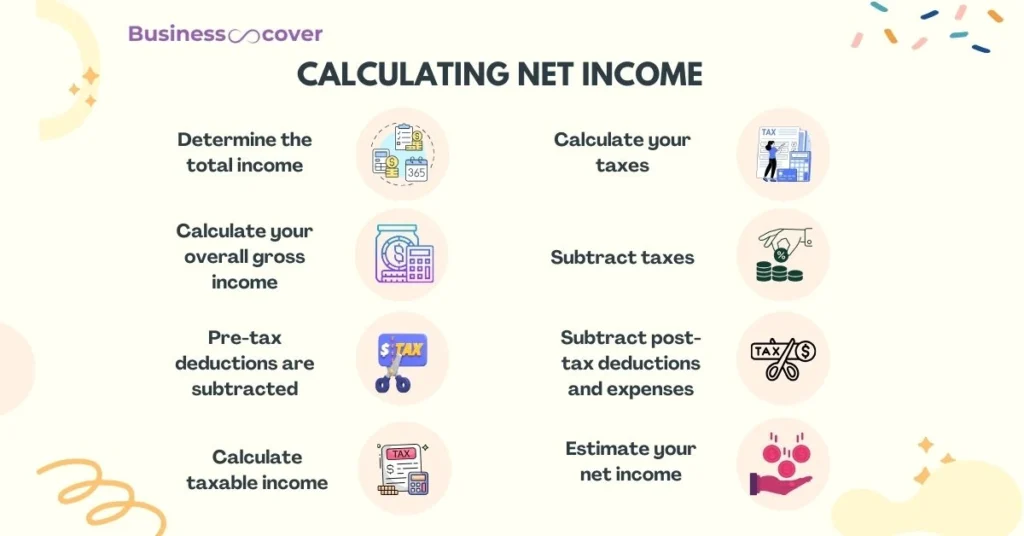

Calculating net income

By so doing, it is possible to come up with the correct net income which will enable to come up with correct income levels hence enable an individual make correct income decisions.

1. Determine the total income

🔹 Total up all income which may be wages, salaries, bonuses, freelance incomes, interests, dividends among other sources of income.

🔹 When completing any assessment that involves income figures make sure that the figures are correct and up to date.

2. Calculate your overall gross income

🔹 The total gross income is obtained by summing up all the possible sources of income.

🔹 Formula: Total Gross Income = Salary + Wages + Bonuses + Other Income

3. Pre-tax deductions are subtracted

🔹 Determine other benefits which may be considered pre-tax deductions, for instance, retirement savings (401(k) or IRA), health insurance amongst others.

🔹 calculate the following from the total gross of income.

4. Calculate taxable income

🔹 To this, subtract the pre-tax deductions from the total gross income.

🔹 Formula: Another definition of taxable income is Total Gross Income – Pre-tax deductions.

5. Calculate your taxes

🔹 The taxes owed should be determined by the audited taxable income. This is federal, state, and local taxes and Social Security and Medicare taxes as well.

🔹 Choose tax brackets and tax rates which would apply to amount according to the individual’s filing status and his gross income.

6. Subtract taxes

🔹 Subtract the estimated taxes from the taxable income Taxes on income in the United States can be estimated from the following formula;

🔹 Formula: Income After Taxes = Taxable Income – Taxes

7. Subtract post-tax deductions and expenses

🔹 There are other deductions which are post-tax adjustments and these include repayment of loans, savings and other expenses..

🔹 Deduct these amounts from the income taxed or use the after tax income formula above to arrive at the figure.

8. Estimate your net income

Deduct all the post-tax deductions and expenses from the amount of income after taxes has been paid.

Formula: Net Income = Gross Income Taxes Less Post Tax Deductions and Expenses

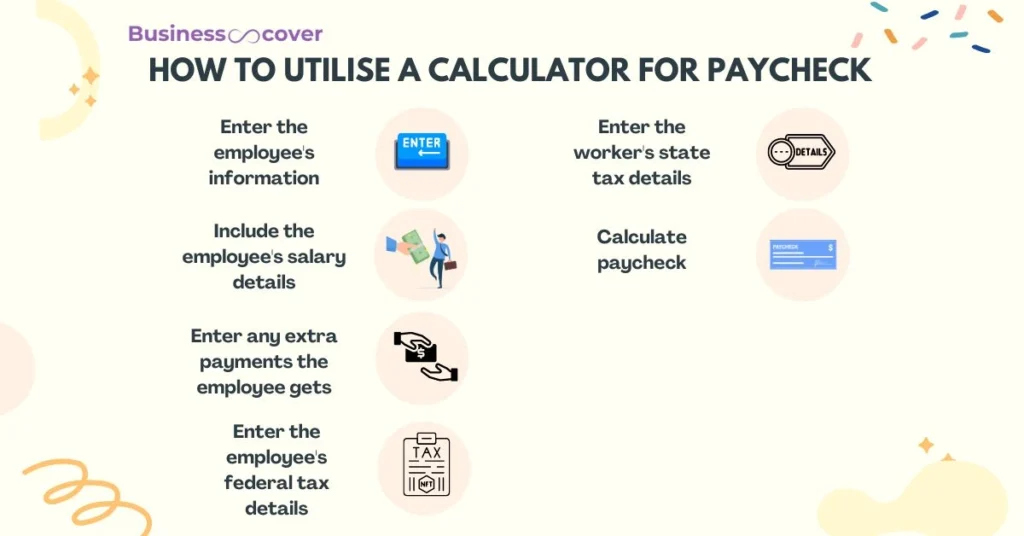

How to utilise a calculator for paycheck

This free paycheck calculator will allow you to enter all your workers’ details so that you can calculate check for all your employees, the hourly paid and the salaried employees.

If you’d like a detailed guide showing you how to use the payroll calculator below is a step by step procedure to follow.

1. Enter the employee’s information

This includes just two items: their name, the state where they live or the city they are in and the state. This will enable the tool determine some of the local taxes that the employee is required to pay.

2. Include the employee’s salary details

You should have fields that have pay type, pay rate, hours worked, pay date and pay period. First, choose pay type from the drop down and then select either ‘Hourly’ or ‘Salary’.

If the employee is hourly, then enter his or her hourly wage under the ‘pay rate’, then the hours this employee worked in that pay period. If the employee worked more than 40 hours, and thus receive overtime, record 40 here and enter the rest in “other pay. ”

If the employee is a salaried employee, both “pay rate” and “hours worked” fields here will be disabled. However, you will have to know how much the employee earns each of the pay periods listed above. You’ll put that into the field labeled “amount.”

Then choose the pay date and the regularity of the employee’s pay — or rather, if it is weekly or every two weeks.

3. Enter any extra payments the employee gets

If the employee is salaried, you will only see two fields: for employees that is bonus and commission. Complete as many of those amounts, as may be required.

If the employee is hourly, you should see four fields: This includes; overtime worked, bonus, commission and other remunerations such as salary. This is the chance where you can put any extra income they should get this pay interval. If the employee received overtime, in the number of overtime hours he or she put in, should be entered here. But concerning California employees, there is one thing that readers should understand: this calculator does not include the double-time pay. The tool uses the time and a half to determineamon how overtime pay is determined.

4. Enter the employee’s federal tax details

Such information may involve the employee’s filing status, number of allowances and any extra withholding requirements. This is information that you ought to be able to obtain from the employee’s Form W-4. If you do not have the employee’s W-4 yet, the calculator can fill the tax rates to provide you the best guess of a paycheck you will need for endowing an accurate estimate.

5. Enter the worker’s state tax details

Again, this consists of the tax payer status of the employee, the number of allowances and other withholding. Some of this information can be obtained from the form W-4 filled by the employee in their state.

6. Calculate paycheck

If you wish to get an idea as to how much the employee is to earn for the given pay period, click on “calculate check.”

A brief of the understanding of tax withholdings and payroll deductions

Tax withholds and payroll deductions can thus be very tricky to understand and yet, it is crucial to make finances work well. Here’s what you need to know:Here’s what you need to know:

Federal income tax withholding

Federal earnings tax withholding is a part of your personnel wages that you take and pay it to the federal authorities on their behalf. In order to decide the correct quantity of tax that must be withheld out of your employees’ paycheck, you have to don’t forget the gross pay of the worker, his or her repute and the quantity of exemptions that she or he takes. There are numerous IRS equipment to be had at the internet to facilitate you to decide the amount of tax desires to be withheld. If they feel that an excessive amount of or too little tax is being credited then they are able to alternate their W-4 forms.

FICA withholding

FICA withholding consist of social security and Medicare taxes. As an employer, there are taxes which are deducted at source as a fixed percentage of the employees salaries and wages for these taxes and another amount contributed by the employer. FICA withholding guarantees that your employees contribute and they too will be enjoying those essential social programs.

Income tax with holdings at state and local level

There is also the state and local tax withholding depending on the location of your business. It is dyed-based and exists in states and localities for leisure, education, transportation, and public safety policies amongst others. It will also be useful to familiarise yourself with your state and local tax laws, in order to deduct the correct amount of taxes from your employees’ checks.

Deductions for benefits

Some of the benefits that are often subject to reduction include savings for retirement; health insurance, among others. In addition to learning possible advantages, having pre-tax benefit deductions presents your employees with monetary improvements and potential savings in total amount of taxes.

Garnishments of wages

Wage garnishments refer to the portion of an employee’s wages that is withheld by court order to cater for debts such as child support, student loans or unpaid taxes. As an employer, you and your organization must follow these orders and make sure that you make the right deductions from your employee’s wages, salaries and other earnings.

People Also Ask

How to calculate payroll?

For the monthly paid-workers it is arrived at by using the formula Total gross salary x Number of months in the year / 12 or Total gross salary x Number of pay intervals in a year. However, the gross compensation of the hourly employees is the total hours worked by such employees multiplied by the hourly rate of pay.

Should I pay tax if my salary is 50000?

The Income Tax Act states that filing income tax returns is required if: To put it simply, a person must have gross total income of more than Rs. 2,50,000 for a given financial year in order to be considered a tax-paying citizen. This upper limit is set at Rs.

How to avoid tax on salary?

It is important to understand on how to avoid tax on salary without being a subject of the law.

To be eligible for tax exemptions, you can purchase the following tools:

- Some of the schemes which developed for the benefit of senior citizens are Senior Citizen Savings Scheme (SCSS).

- Sukanya Samriddhi Yojana (SSY)

- National Pension Scheme (NPS)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)