What is Accounting for Management?

In fact, what is accounting for management? This is one of the most important questions that any business organization has to answer in order to run successfully. Accounting in management hence has a critical role in making sure that anybody who wants to make a decision has the correct financial information. If there is clarity with respect to the meaning and definition of management accounting, organizations can be placed on a pedestal to facilitate the correct utilization of financial information for planning and control purposes. Further, this article presents the objectives of management accounting, the advantages of its utilization, and key principles, which will help to describe the significance of this concept for modern companies.

Understanding Management Accounting

In an attempt to define management accounting, it would be important to assess what it is not; financial accounting. Financial accounting involves the accumulation of historical facts, adherence to GAAP and preparation of external financial statements On the other hand, management accounting produces forecasting information, which is germane to internal decision-making.

Definition of Management Accountant

A management accountant is also a financial officer charged with the duty of presenting, interpreting, and budgeting organizational financial data. This role is central to the work of providing complex interpretations of accounting for managers as crude data. They are a crucial part of a company’s modelling team to assist with planning in competitive and intricate financial markets.

Key Concepts in Management Accounting

- Cost Analysis: Product or service costs are a crucial element in pricing strategies so their determination must be clear. Therefore understanding the distinction between fixed and variable costs enables businesses to make better prices that lead to improved profitability.

- Budgeting: The formulation of some kind of financial plan which states likely revenues and expenses assists organisations in planning for the use of available resources. An effective budget is a tool that helps in tracking the performance against specific goals which further helps in decision-making.

- Variance Analysis: This is done by comparing actual figures with the budget and looking at variance to see where and by how much the organisation is off its target. Variance analysis is widely applied by management accountants to measure the efficiency of an organisation’s performance and maintain financial control.

- Performance Measurement: It is essential to use a variety of different measures to evaluate departmental and corporate effectiveness and to make improvements continually. The profitability indices include the Return on Investment (ROI), and the Economic Value Added (EVA) among others, assist the organisation to determine its economic status.

- Strategic Management: The practices of management accounting are becoming integrated into the planning of strategies. This paper terms these as Market Dynamics, positioning, and behavior analysis are vital in enabling organizations to make strategic management decisions.

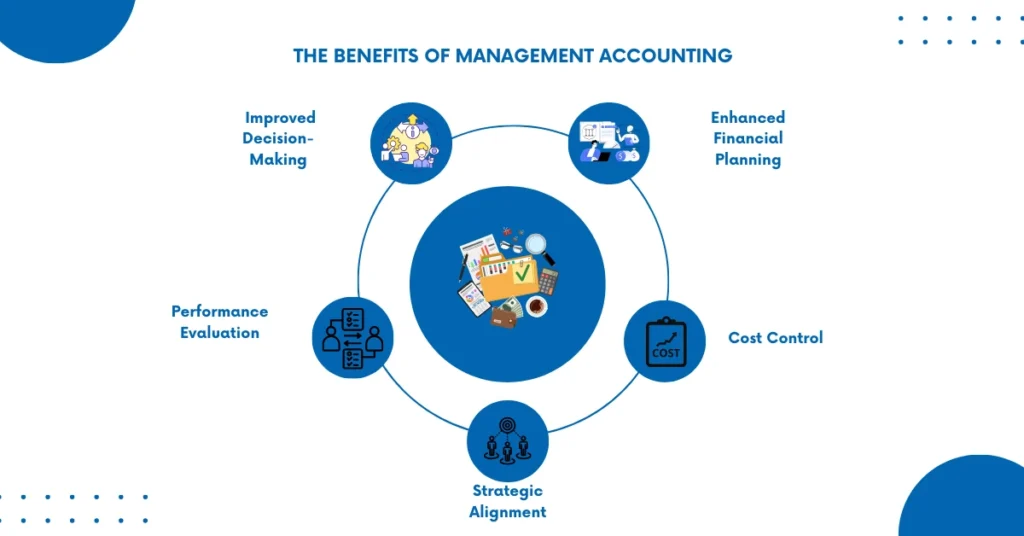

The Benefits of Management Accounting

Accounting management and comprehending include acknowledging the following about what is accounting management. Here are some key accounting advantages that management accounting brings to an organization:

1. Improved Decision-Making

A common objective of management accounting is to provide helpful information to decision-makers. In this way, management accountants can help leaders make correct decisions based on real-time data that meet strategic goals. Availability of relevant financial data improves the quality of decision-making on the dissemination of new resources, utilization of existing resources as well as changes in operations.

2. Enhanced Financial Planning

Management accounts definition emphasizes the importance of forward-looking financial planning. By utilizing forecasting techniques, businesses can anticipate future financial scenarios and allocate resources accordingly. Effective financial planning enables companies to set realistic targets and adapt to changing market conditions.

3. Performance Evaluation

Management accounting also offers various measures of the performance of departments and more generally of the organisational performance. It is essential to carry out such an evaluation for improvement and to account: Management accountants always assess the performance indicators to check that every facet of the organization has a positive effect on the company’s objectives.

4. Cost Control

Management accounting enhances the recognition of wasteful expenses and helps reduce their occurrences. This paper is about cost control and the level of performance improvement as an aspect of analysing the feasibility of the economic activities of an organisation with a view to improving profitability and thereby fostering sustainable growth. There can be no effective business operation without measures that can relate to cost control measures such as the identification of cost drivers and cost reduction measures which are paramount in cost control.

5. Strategic Alignment

Management accounting objectives are as follows: Targeted financial objectives should match business styles and plans. This alignment makes certain that funds available are properly employed bearing in mind only that which serves long-term endeavors. Strategic Management accountants involve themselves with strategic planners and make it easier to feed financial information into the strategic planning process resulting in proper resource allocation.

The Relationship Between Management Accounting and Financial Accounting

While financial accounting is primarily concerned with external reporting, management accounting focuses on internal decision-making. Understanding what is the management accounting involves recognizing that both areas complement each other.

- Financial Accounting:

- Historical data

- Compliance with regulations

- External stakeholders (investors, creditors)

- Management Account

- Forward-looking insights

- Internal stakeholders (management)

- Strategic decision support

What is a Management Account?

A management account is a tailored report designed for internal use. It summarizes financial performance, forecasts, and variance analyses, enabling management to make timely decisions. The definition of management account underscores its role as a vital tool in operational oversight. Management accounts typically include:

- Profit and Loss Statements: Illustrating revenues, costs and profits on a particular time span.

- Balance Sheets: Discussing the long-term and short-term assets, long-term and short-term liabilities and the organization’s equity.

- Cash Flow Statements: Offering information on operations of cash receipts and cash payments.

Management Accountant: Skills and Responsibilities

To understand what is accounting for management, one must appreciate the skills and responsibilities of a management accountant. Key competencies include:

- Analytical Skills: the most important skill is the foreign analysis necessary to decode the financial information and cull strategic meaning from it. Management accountants also make use of statistical methods and applications in computing the trends and likely future performances.

- Communication: It is important to communicate financial information to other stakeholders within any organisation. This means that for a management accountant, communication must be adjusted based on the class or level of employees from the company executives to the workers.

- Technical Proficiency: The key to discerning data analysis and reportage, therefore, requires a working knowledge of accounting software and financial modelling. These changes make it necessary to have a continuous learning process in the area with regard to the new financial technologies.

Attention to Detail: There is no doubt that the accuracy of financial reports is crucial. It also means that management accountants need to be absolutely ethical and accurate in their reports.

Objectives of Management Accounting

When we discuss the objectives of management accounting, we communicate the major purposes the practice is aimed at. These include:

- Planning and Forecasting: Predicting and planning are central to the achievement of certain financial objectives. Studying the future and making its predictions helps organisations be ready for emerging issues and take the emerging opportunities.

- Control: This makes it important to constantly check on the financial outcomes and where necessary take the corrective action needed to ensure compliance to set budgets. The use of resources in organizations can be controlled by effective control systems.

- Decision Support: Serving precious financial data to help decision-making is one of the primary objectives of management accounting. These concerns carry out the organizational scenario and also the organizational sensitivity analysis with a view to assessing the viability of strategic plans.

- Resource Allocation: The efficiency of the usage of the available financial resources is one of the significant goals. Management accountants also assist in selecting and recommending activities that would best achieve the goals of an organisation.

Also Read | Maximize Results with Ratio Accounts: Accounting Ratios and Formulas

Management Accounting Techniques

Management accounting involves certain techniques that help an organization enhance the performance of its techniques and strategies. Key techniques include:

1. Budgeting Techniques

- Zero-Based Budgeting: All expenditures need to be explained for the new intervals, thus the concept of cost control is enhanced. It makes the manager begin thinking tactically on how and where to spend the money and what are the necessary expenses to be incurred.

- Flexible Budgeting: Reallocation of funds in relation to fluctuations in activity volumes, improves the work of budgeting. This technique is helpful in that it enables an organisation to become more responsive to potential future shocks; the organisation will be financially secure.

2. Costing Methods

- Activity-Based Costing (ABC): Subsidiary products are cost allocated from the overhead costs based on the activities that really incurred the costs, thus accurate costing of the products to be subsidized. If organizations can precisely study cost behaviour, then it will be easier for them to fix accurate prices which lead to increased profitability.

- Standard Costing: Has predetermined cost for products and services enabling a variance analysis to be made. This method assists the management in determining where actual performance differs with the anticipated one and taking necessary measures.

3. Financial Ratio Analysis

Looking at the different things in the figure Readers can see that thru the different financial ratios computed by management it is able to determine the firm’s performance in terms of profitability, liquidity as well as solvency. Key ratios include:

- Current Ratio: Measures an organization’s capability to honor short-term liabilities.

- Return on Equity (ROE): Associated with and explains how efficiently a business enterprise applies shareholders’ equity to earn revenue.

- Gross Margin Ratio: Gives an indication of a company’s manufacturing effectiveness by dividing gross profit by revenues.

Challenges in Management Accounting

Despite the numerous benefits associated with management accounting, there is always some inherent challenges encountered by organizations while implementing management accounting. Common challenges include:

- Data Quality: Maintaining the accuracy and credibility of the financial information is very important in management decisions. Hence poor quality, data results in poor quality and misleading conclusions and thus the strategies developed are utterly wrong.

- Integration with Technology: Another challenge mentioned by the respondents is compatibility; as more and more organisations turn to technology, linking MAS to current IT systems may pose a problem. They also said that management and training are key factors that will help make the implementation successful.

- Changing Business Environments: There is a real danger that timely and accurate management accounting information will be affected by rapid changes in product markets and evolving regulations. It must also be appreciated that in a constantly changing environment, organisations have to adjust their accounting systems perceptibly.

Conclusion

In conclusion, what is accounting for management is an imperative organiser that aids in the decision-making, planning and control in the firms. It is for this reason that the management accounting explanation coupled with other related benefits makes it possible for a business organization to exploit financial information to enhance its growth and operation.

Emphasizing the objectives of management accounting increases the standard of financial control and thereby increases accountability and transparency at companies. This paper ascertained that, as business organizations continue to experience high uncertainties within their evolving economic environments, management accountants will play a significant function in providing insights for decision-making and organizational success.

This paper aims to establish that through the understanding of management accounting, organisations are capable of achieving the best results and correlating organisational goals with long-term objectives necessary for growth and sustenance in the growing marketplaces. Applying the tenets of accounting in management is sure to produce impressive returns in meaningful organizational efficiency and financial solidity.